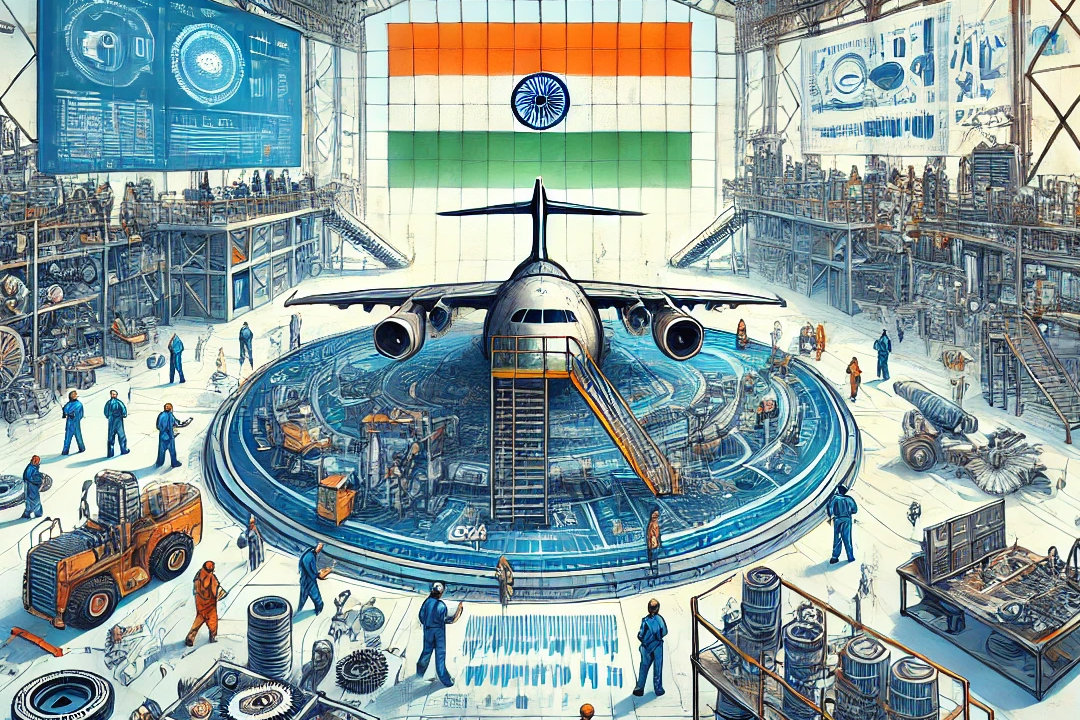

Union Government is set to enhance India’s competitiveness in the global aviation market, potentially establishing the country as a prominent hub for Maintenance, Repair, and Overhaul (MRO) operations. This development aligns with the burgeoning growth of the Indian aviation sector, which is poised to expand its aircraft fleet significantly by FY2025, necessitating a robust MRO infrastructure to support this rapid growth. Jaideep Ramchandani explores the recent shifts in India’s MRO sector in this article.

In this year’s budget, the Union Government announced the decision to apply a uniform five per cent Integrated Goods and Services Tax (IGST) rate on all aircraft and aircraft engine parts. This move is likely to make a big impact on the Maintenance, Repair, and Overhaul (MRO) industry in India and help in developing the country as a global aviation hub. Earlier, the IGST rates on imported and exported parts varied from five per cent to 28 per cent.

The timing of this tax exemption could not have come at a better time considering the tremendous growth opportunities that India’s MRO sector is brimming with. Affirming that the Indian aviation sector is soaring to unprecedented heights, CAPA India recently observed that the country’s fleet order is projected to approach 2,000 aircraft by the end of FY2025, up from the current 1,620. With this kind of expansion, a robust MRO sector will be vital for the health of India’s aviation ecosystem.

On the sidelines of the Aviation India 2024 Summit, held in New Delhi in June, news has also trickled in regarding global giants’ proposed investments in the MRO sector. These names include Rolls-Royce, which has hinted that the company is considering the idea of an MRO base in India, though it has not drawn up a deadline for the same.

Rolls-Royce currently has MRO operations in Hong Kong, China, the UK, the US and Singapore. Though there have not been any official announcements in this regard, we cannot completely brush aside the possibilities of such a facility in India, especially considering the orders they have received from Indian airlines for engines. Earlier this year, Rolls-Royce announced an order from Air India for 68 Trent XWB engines and 12 Trent XWB-84 engines. Apart from Air India, IndiGo has also placed orders for the Trent XWB engine.

The MRO segment is divided mainly into line maintenance, component maintenance, airframe heavy maintenance and modification engine maintenance. Aircraft engines typically require maintenance over their 20-year lifespan, and at present, most of the maintenance work for Indian carriers is done in facilities overseas. In this context, expanding MRO services in the country will provide numerous advantages, including lower costs, reduced turnaround time, less inventory for airlines, reduced foreign exchange outflow, greater employment opportunities and the strengthening of domestic capabilities.

The development of India’s MRO ecosystem however will be a gradual process and calls for collaboration among aviation stakeholders, particularly given the rapid growth in passenger traffic and large aircraft orders. According to Deloitte’s ‘MRO in India – Poised to Take Off’ report, the Indian MRO industry is expected to increase from US$ 1.7 billion in 2021 to US$ 4.0 billion by 2031, at a compound annual growth rate (CAGR) of 8.9 per cent, compared to the expected global CAGR of 5.6 per cent. With more than 1,000 aircraft currently on order, the report predicts that there will be a demand for 200-300 major maintenance checks annually, in addition to the redelivery work for replacing ageing aircraft.

Here, the airlines that have placed orders can advocate for MRO facilities to be established domestically by aircraft Original Equipment Manufacturers (OEMs) and include such provisions in contracts. The OEMs can also explore options for collaborating with existing Indian MRO players to set up authorised repair centres, utilising the domestic capabilities that are now handling sub-segments such as airframes, engines, components, and line checks. In the long term, this can be extended to high-value checks like engine and component maintenance.

To facilitate the entry of more MRO players into the market, there is a need to simplify Indian regulations, which are often seen as complex and stringent. The government has already taken key steps for policy improvements, including easing approval processes and reducing taxes on MRO services. Other measures include allowing 100% Foreign Direct Investment (FDI) via the automatic route for MROs, exempting customs duty on tools and tool kits, simplifying the clearance process for parts, abolishing royalties, and providing clear guidelines for allocating land at airports managed by the Airports Authority of India (AAI) for MROs. These favourable policies will help MROs plan and invest more confidently in India.

The government has announced plans to invest over US$1 billion in MRO infrastructure over the next decade. We have also witnessed the expansion of MRO facilities at major airports like Indira Gandhi International Airport in Delhi, which became the first facility in India with two dedicated MRO hangars for the general aviation terminal. The expansion plans implemented at Mumbai and Bengaluru, as well as near the upcoming Noida International Airport, can also attract global airlines.

Recently, Hindustan Aeronautics Limited (HAL) announced plans to establish an integrated MRO hub in the country. Airbus is partnering with HAL to help them in this effort and will assist, particularly for the A320 family of aircraft.

To develop an efficient MRO sector in India, it is also necessary to focus on skills and workforce development. According to estimates by Airbus, India will need 41,000 pilots and 47,000 technicians in the next 20 years to support its growth. Recently, when asked about skill shortages among technicians and engineers in Parliament, Minister of State for Civil Aviation Murlidhar Mohol noted that the Directorate General of Civil Aviation (DGCA) has issued regulations under CAR-147 (Basic), which approve Basic Maintenance Training Organisations. He said these regulations align with international standards set by ICAO and EASA and improve the overall quality of training. Initiatives like the National Skill Development Corporation (NSDC) are also focusing on creating specialised training programs for MRO. New collaborations between MRO companies and training institutions can effectively develop a more skilled workforce.

Modern-day aircraft are capable of generating huge volumes of data related to engine performance, temperature, pressure and other critical parameters. This information can be used to improve the maintenance, efficiency and safety of the carrier. To handle this large amount of data, it is essential to leverage big data analytics technologies like Artificial Intelligence (AI) and Machine Learning (ML). These technologies can optimise maintenance schedules and reduce aircraft downtime, while digital tools assist in predictive maintenance, further reducing downtime and costs.

While setting up a dedicated MRO sector for India, the focus of new players will be on moving towards more automated and data-driven solutions, with an emphasis on sustainability. To sum up, a coordinated effort between policymakers, airlines, OEMs, training institutes, and technology companies is vital for India to achieve its ambitious target of becoming a global MRO hub.