In a significant development marking a strategic investment move, global investment giant KKR has announced the signing of definitive agreements to acquire Healthium Medtech Ltd, a renowned Indian medical devices company, from an affiliate of funds advised by Apax Partners LLP, a leading global private equity advisory firm. The acquisition is poised to bolster KKR’s footprint in the healthcare sector and strengthen Healthium’s position as a key player in the global medical devices market.

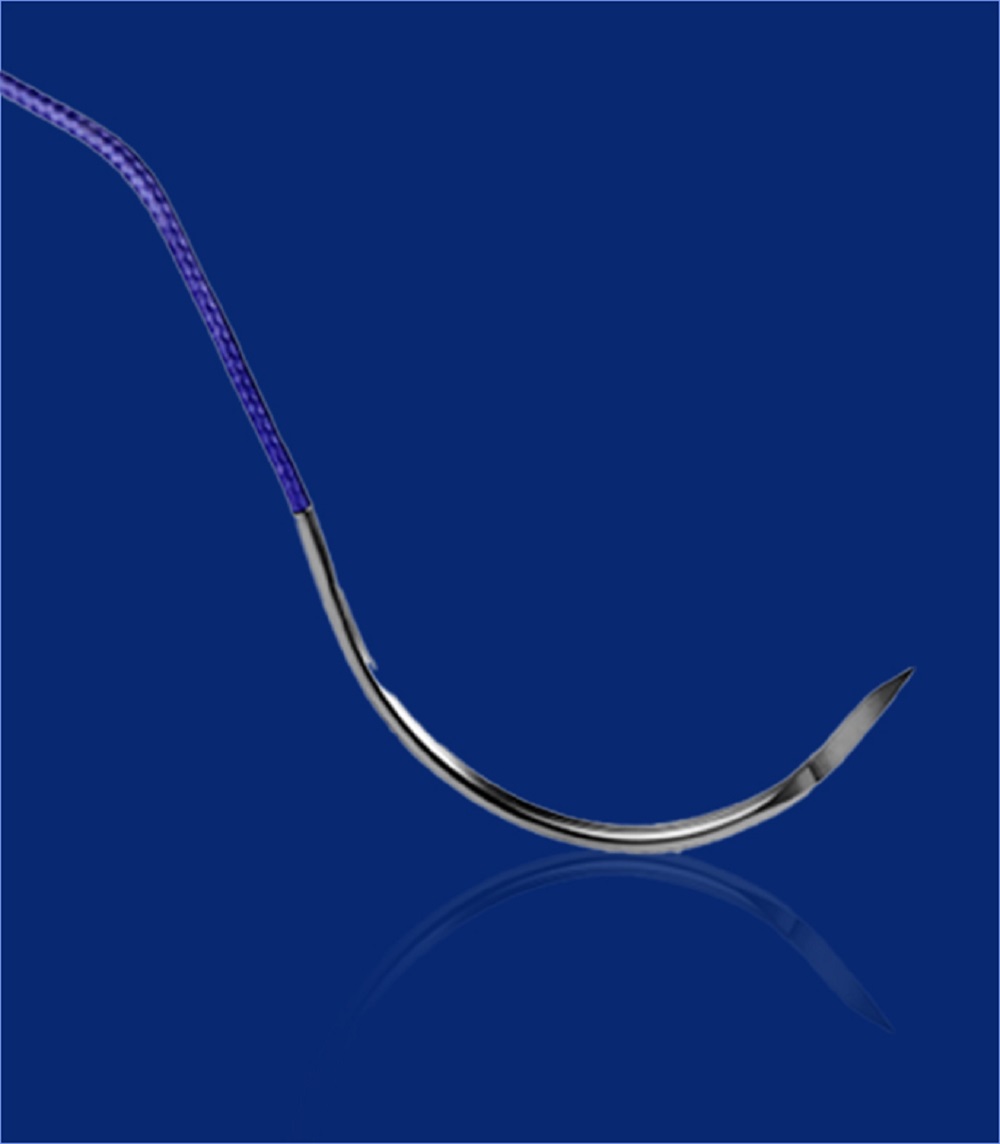

Founded in India in 1992, Healthium has emerged as a prominent player in the medical devices arena, specializing in the development, manufacturing, and distribution of a diverse range of surgical products globally. Its extensive portfolio, characterized by high-quality offerings, encompasses products tailored to meet the diverse needs of surgeons, including wound closure, arthroscopy, and advanced wound closure solutions.

Apax Funds, following their acquisition of Healthium in 2018, played a pivotal role in transforming the company from a domestic suture player into a global leader in medical devices. With strategic investments and operational enhancements, Healthium expanded its portfolio, strengthened its management team, and significantly increased its global presence, now reaching over 90 countries.

Commenting on the acquisition, Akshay Tanna, Partner and Head of India Private Equity at KKR, expressed enthusiasm about leveraging KKR’s global network and healthcare expertise to accelerate Healthium’s growth trajectory. He emphasized KKR’s commitment to supporting Healthium’s expansion through organic and inorganic growth strategies, underscoring the company’s potential in the burgeoning healthcare sector.

Steven Dyson, Partner at Apax, highlighted the successful collaboration between Apax and Healthium in creating a robust global MedTech platform. He commended Healthium’s remarkable growth journey and expressed confidence in the company’s continued success under KKR’s stewardship.

Anish Bafna, Chief Executive Officer of Healthium, lauded the company’s exponential growth over the past five years, with its products now integral to one in every five surgeries worldwide. Bafna welcomed KKR’s investment, citing the firm’s extensive global healthcare expertise and deep knowledge of the Indian market as valuable assets for Healthium’s future growth endeavors.

KKR’s investment in Healthium underscores its continued commitment to the healthcare sector in India and the Asia Pacific region. This landmark transaction is expected to fortify Healthium’s market position and accelerate its growth momentum in the dynamic medical devices landscape.

The acquisition is subject to regulatory approvals and is anticipated to conclude in the third quarter of 2024. Financial terms of the deal were not disclosed. Apax Partners and Healthium received financial advisory services from Jefferies LLC and legal counsel from Kirkland & Ellis LLP, while KKR was advised by Moelis & Company as financial advisor and Simpson Thacher & Bartlett and AZB & Partners as legal counsel.