In July, new car sales in the European Union edged up by a modest 0.2%, as declines in France and Germany significantly dampened the overall market performance, according to data released by the European Automobile Manufacturers Association (ACEA) on Thursday.

While the sales of battery-electric vehicles (BEVs) continued to lose ground, a stark contrast was observed in the broader market for electrified vehicles, which includes fully electric models, plug-in hybrids, and hybrid-electric cars. The BEV market experienced a substantial setback, with Germany, a major player in the sector, witnessing an alarming 37% drop in battery-electric vehicle sales.

This sharp decline overshadowed improvements in the electric vehicle (EV) markets of Belgium, the Netherlands, and France, where sales saw some positive movement. Despite these regional gains, they were insufficient to counterbalance the significant downturn in Germany’s BEV market.

The varied trends in car sales across the EU highlight the impact of differing national policies on green incentives. While some countries have robust support systems in place to encourage the adoption of electric vehicles, others are lagging, creating a patchwork of results across the bloc.

This divergence is further complicated by the regulatory landscape, where the European Union has imposed stringent tariffs to curb the influx of inexpensive Chinese EVs, aiming to protect the domestic auto industry. Electrified vehicles, a category that encompasses fully electric cars, plug-in hybrids, and full hybrids, have shown a notable increase in market penetration.

In July, these vehicles accounted for 50.9% of all new passenger car registrations in the EU, up from 47% in the same month last year. However, the detailed breakdown reveals contrasting trends within this category. While sales of battery-electric vehicles and plug-in hybrids declined by 10.8% and 14.1%, respectively, hybrid-electric cars saw a significant surge, with a 25.7% increase in sales.

This suggests a shifting consumer preference within the electrified vehicle segment, possibly influenced by factors such as cost, range anxiety, and infrastructure availability. The performance of Europe’s leading car manufacturers further underscores the challenges facing the industry.

Volkswagen, Stellantis, and Renault, the three largest automakers in the region, all recorded declines in car registrations in July compared to the previous year, with decreases of 2.2%, 5.2%, and 1.7%, respectively. This downturn can be attributed to several factors, including growing competition from Chinese automakers.

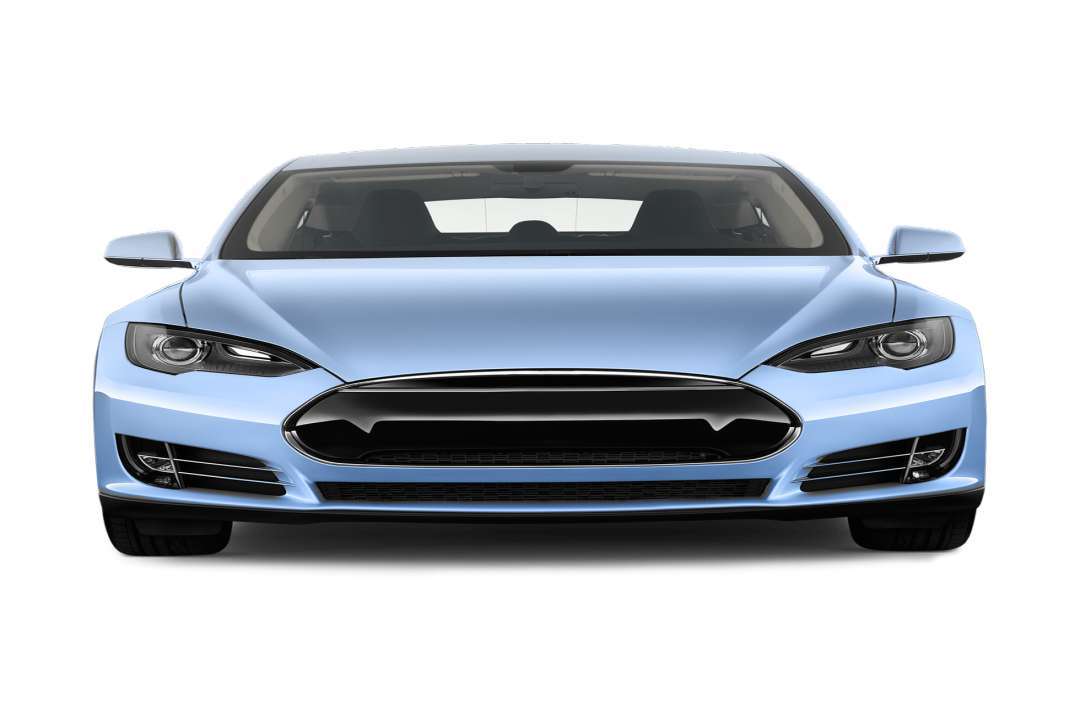

For instance, Tesla, a key player in the EV market, saw its sales drop by 14.7%, while China’s SAIC Motor, a rising competitor, experienced a robust 24.2% increase in sales. Amid these dynamics, the European Commission took a notable step on August 20 by reducing the proposed tariff on Tesla cars manufactured in China to 9%.

This move comes as part of a broader strategy to regulate imports of Chinese-made electric vehicles, where tariffs could reach as high as 36.3%. Meanwhile, Stellantis, which faced the steepest decline in sales among EU carmakers, has reported a more significant than anticipated drop in revenue and operating profit for the first half of the year, attributing this to both external market pressures and internal operational challenges.