Epsilon Carbon Pvt Ltd’s subsidiary is poised to secure offtake agreements for lithium-ion cell anode materials within the next six months for its planned manufacturing facilities in the US and India, according to managing director Vikram Handa.

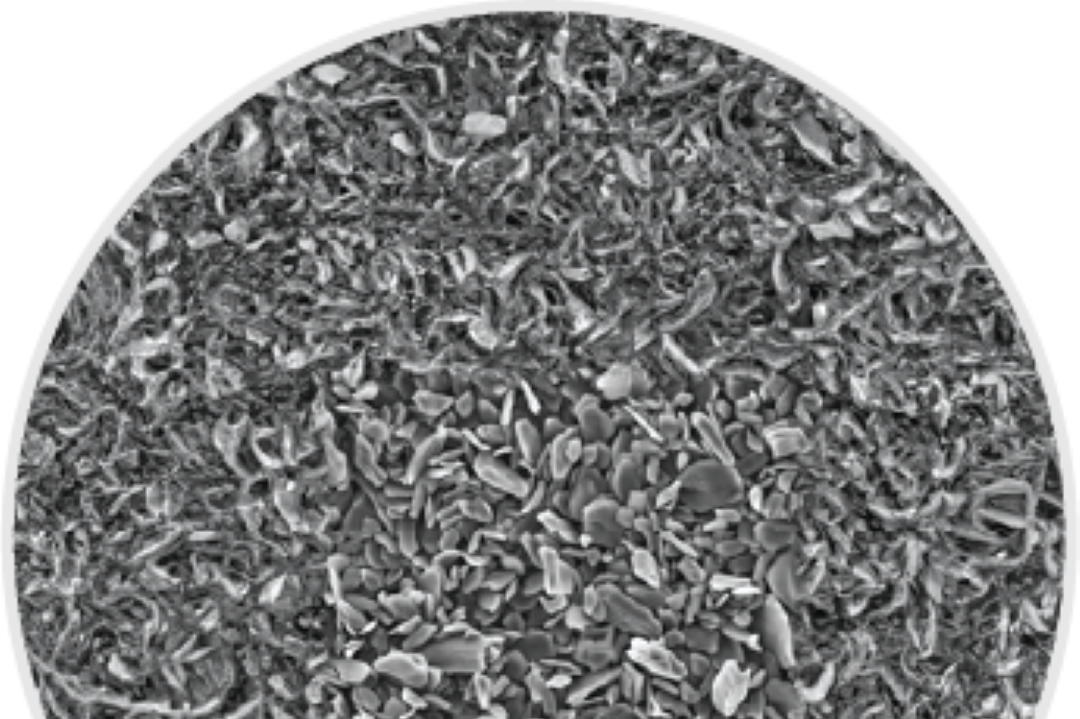

Epsilon Advanced Materials Pvt Ltd has already passed customer qualification for commercial production at both locations. Finalizing take-or-pay contracts with these clients is the last step before moving forward with plant construction, Handa stated. Anodes, which form the negative terminal in lithium-ion batteries, are essential for powering electric vehicles and electronic devices.

Epsilon Expansion Plans

The company plans to establish two 30,000 tonnes-per-year capacity plants, one in the US and one in India, which will be the largest anode material manufacturing facilities outside China. While the US plant will primarily serve the American market, the Indian plant will initially focus on exports. Handa noted that the US currently only has a 10,000-tonne annual capacity, and Epsilon aims to triple that.

Additionally, Epsilon is exploring a similar plant in Finland, though regulatory approvals could delay progress by 18 months. Although companies like Tata Group, Reliance Industries, and Ola Electric are building lithium-ion cell plants in India, none have yet signed supply agreements with Epsilon. Handa explained that Indian companies are still sourcing materials from China, so Epsilon has focused on export markets like Korea and Japan.

Further Expansion in India

Epsilon has also made provisions for additional capacity in its upcoming Indian plant to meet future domestic demand. The company is exploring the possibility of establishing cathode production facilities for lithium-iron-phosphate (LFP) cells in India. While the anode material remains consistent across different lithium-ion chemistries, cathode material varies.

The company anticipates investing around ₹9,000 crore in its anode material plants and ₹5,000 crore in cathode production over the next 6-7 years. So far, the company has invested over ₹700 crore in research, development, and pilot plants.

According to a Crisil report from February, strong demand for lithium-ion batteries is expected to drive the growth of bulk mesophase coke, a key precursor for synthetic graphite anodes. Demand is projected to remain robust in the medium term.