Continental’s earnings for the second quarter of 2024 exceeded expectations, showing strong growth across all three business sectors compared to the first quarter of the year. The company also saw significant year-on-year earnings improvements. In the Automotive sector, price adjustments and initial savings from cost-cutting measures boosted results. The Tires sector performed well, largely due to a robust tire-replacement market in Europe. ContiTech also benefited from cost management and price adjustments, despite a weak industrial market. Continental has revised its outlook due to anticipated lower production of passenger cars and light commercial vehicles.

Continental’s CEO, Nikolai Setzer, noted the company’s progress across all sectors, particularly in Automotive, and expressed optimism about future improvements. CFO Olaf Schick highlighted that cost reduction measures are beginning to show results and emphasized continued efforts to meet financial targets.

For Q2 2024, Continental reported sales of €10 billion, a decrease from €10.4 billion in the same quarter last year. The adjusted operating result rose to €704 million, up from €501 million, with an adjusted EBIT margin of 7%. Net income reached €305 million, a 46.2% increase from the previous year, and adjusted free cash flow was €147 million, compared to a negative €14 million last year.

Vehicle production globally saw a slight decrease, down 1% to 22.1 million units. In Europe, production dropped 6% to 4.3 million units, while North America saw a 2% increase to 4.2 million vehicles. China’s production grew by 5%, reaching 7 million units.

Continental has adjusted its full-year forecast, expecting consolidated sales of €40 to €42.5 billion, down from the previous range. The company anticipates a slight decline in passenger car and light commercial vehicle production, particularly in Europe.

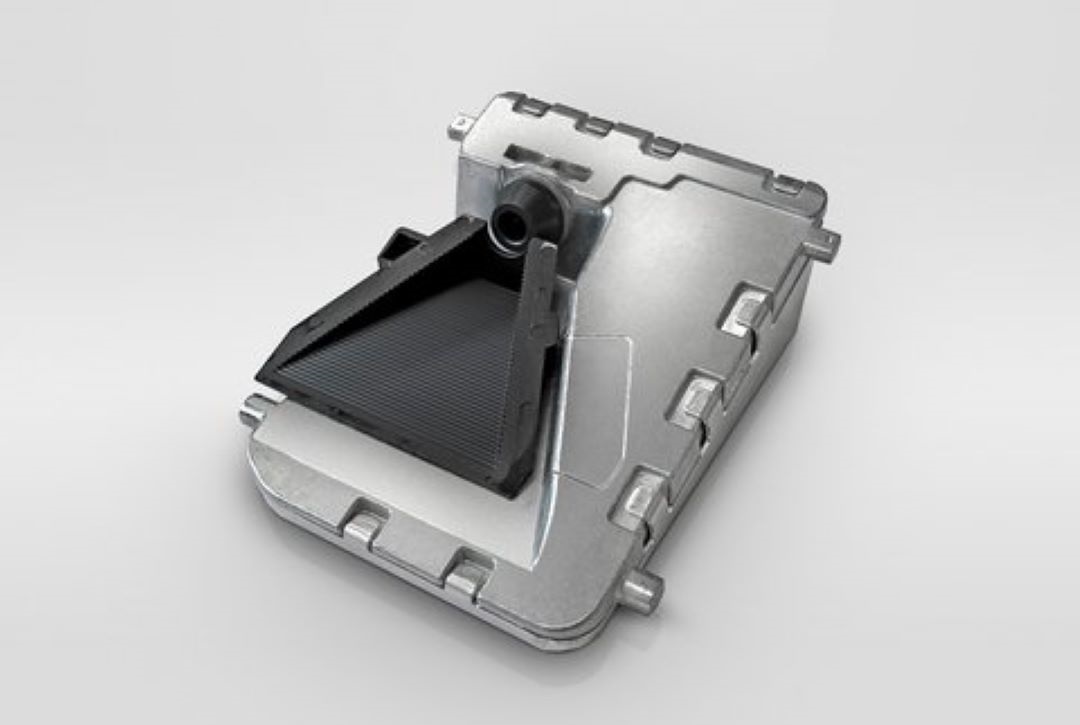

In the Automotive sector, sales fell 3.4% to €5 billion, but the adjusted EBIT margin improved to 2.7% due to price negotiations and cost cuts. The Tires sector generated €3.4 billion in sales with a higher EBIT margin of 14.7%, driven by a strong tire-replacement business in Europe. Continental’s tire plant in Lousado, Portugal, now produces tires with carbon-neutral processes and has won several sustainability awards.

ContiTech posted sales of €1.6 billion and an improved EBIT margin of 7.1%. Despite weak industrial demand, strict cost control and price agreements boosted earnings. ContiTech also secured a major order for a high-capacity conveyor belt, valued at approximately €40 million.