The Society of Indian Automobile Manufacturers (SIAM) data for July 2025 indicates a steady but uneven performance across vehicle categories. While overall production and sales volumes reflect resilience, underlying trends reveal diverging fortunes for different segments.

In July 2025, total vehicle production—covering passenger vehicles, two-wheelers, three-wheelers, and quadricycles—reached 26.98 lakh units, a 10.7% rise from July 2024’s 24.37 lakh units. Domestic sales stood at 19.38 lakh units, up 7.8% year-on-year, while exports surged 30.5%, crossing 5.41 lakh units. This performance highlights the industry’s growing role in export markets, even as domestic growth remains moderate, particularly for passenger vehicles.

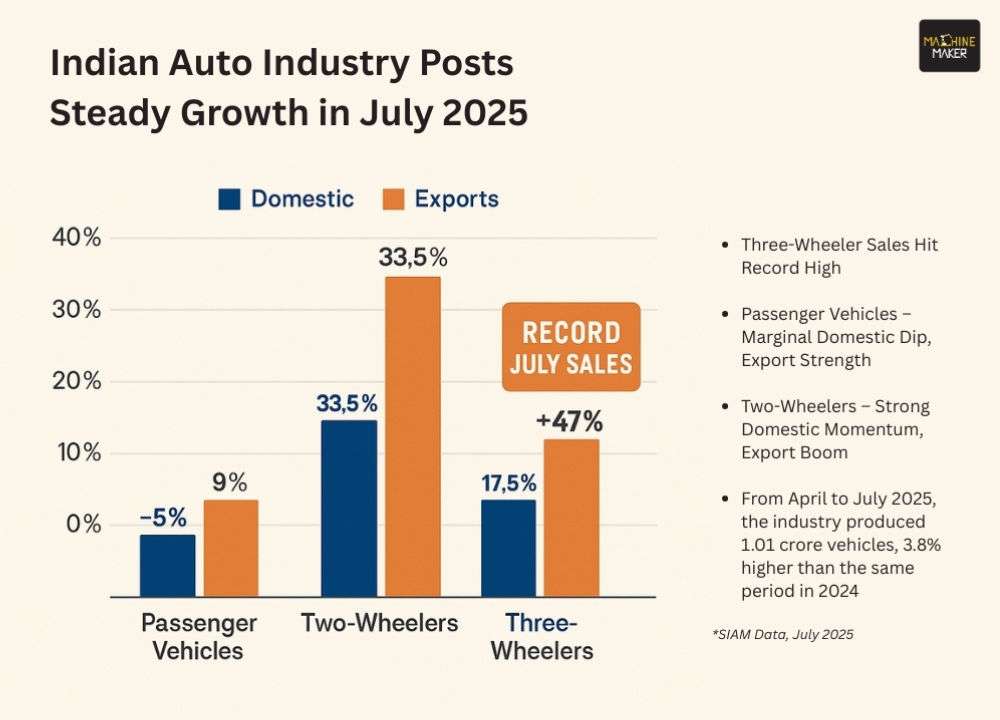

Passenger Vehicles – Marginal Domestic Dip, Export Strength

Passenger vehicle (PV) sales closed July 2025 at 3.41 lakh units, down 0.2% from July 2024. This slight decline is driven primarily by a 3.7% fall in passenger car sales, which dropped to 1.44 lakh unit. However, utility vehicles (UVs) continued to gain traction, up 2.5% to 2.41 lakh units, while van sales were almost flat.

Export performance for PVs was far stronger—up 8.7% to 67,292 units—driven by demand for passenger cars (+9%) and UVs (+8.1%). Production remained stable at 3.98 lakh units, with growth in UV manufacturing offsetting the car segment’s contraction.

Three-Wheelers – Record July Sales

The three-wheeler segment stood out in July 2025, recording its highest-ever July domestic sales at 69,403 units, up 17.5% year-on-year. Passenger carriers led this surge, growing 21.4% to 58,693 units, while goods carriers rose 10.6%. Interestingly, e-rickshaw sales fell sharply (-53.3%), but e-carts surged 161.6%, albeit from a smaller base. Production rose 24% to 1.12 lakh units, while exports posted a spectacular 47% jump to 39,787 units, marking a growing global footprint for Indian three-wheeler manufacturers.

Two-wheelers continued to provide the volume backbone of India’s auto industry, selling 15.67 lakh units domestically in July 2025, a healthy 8.7% increase over July 2024. Scooters led with 16.2% growth, reaching 6.43 lakh units, while motorcycles rose 4.7% to 8.90 lakh units. Mopeds, however, saw a 9.5% decline in domestic sales.

Production touched 21.88 lakh units, up 12.3%, supported by export momentum—shipments abroad grew 33.5% to 4.34 lakh units. Notably, moped exports saw the highest growth rate, up an extraordinary 382.8%, indicating rising niche demand overseas.

Cumulative April–July 2025 Performance – Mixed Domestic, Strong Export Growth

From April to July 2025, the industry produced 1.01 crore vehicles, 3.8% higher than the same period in 2024. Domestic sales in this four-month window slipped 2.3%, mainly due to a 0.7% decline in passenger vehicles and a 2.9% fall in two-wheeler sales. Exports in the same period surged 24.4%, led by motorcycles (+30.6%), utility vehicles (+21.4%), and three-wheeler passenger carriers (+37.7%).

These trends suggest that while the domestic market has faced some headwinds, possibly linked to cautious consumer sentiment and delayed purchasing decisions ahead of the festive season, India’s manufacturing competitiveness is translating into stronger international demand.

Commenting on the July 2025 performance, SIAM Director General Rajesh Menon noted that passenger vehicle demand remains subdued, but other segments are showing resilience. The record July sales for three-wheelers and the sustained growth in two-wheeler volumes reflect robust rural and urban mobility needs. With the festive season beginning in late August with Onam, the industry is cautiously optimistic about an uptick in demand.

Key Takeaways

- Exports are the growth engine – All major segments saw strong export growth, particularly motorcycles and three-wheelers.

- Passenger vehicles face headwinds – Utility vehicles are propping up the segment, offsetting weakness in cars.

- Three-wheelers are in a growth cycle – Domestic and export demand are both at multi-year highs.

- Two-wheelers remain the industry’s backbone, supported by urban scooter demand and rural motorcycle purchases.

- Festive season will be the next inflexion point – Demand patterns in September–October will determine the momentum for the rest of FY2025–26.