Tessolve, the largest independent semiconductor engineering services firm globally and a venture of Hero Electronix, has announced a significant $150 million investment from TPG, a leading global alternative asset management firm. The funds will be used to strengthen its global delivery centers, expand advanced testing laboratories, and accelerate strategic acquisitions, as Tessolve looks to solidify its position as a key player in both the global and Indian semiconductor markets. The investment was made through TPG Growth, TPG’s platform for middle-market and growth equity investments.

Ujjwal Munjal, Vice Chairman of Hero Electronix and Chairman of Tessolve, commented, “This investment marks a key milestone for Tessolve and reflects Hero Electronix’s vision of building world-class technology ventures from India. I extend my gratitude to the entire Tessolve team for their dedication in making this achievement possible. With TPG’s support, Tessolve is poised to scale further, becoming a critical player in the global semiconductor ecosystem and driving the development of the Indian semiconductor industry.”

Hero Electronix entered the semiconductor industry in 2016 with the acquisition of Tessolve, marking the Group’s entry into deep-tech. Since then, Tessolve has grown into a global leader in engineering services, attracting institutional investors and increasing revenues from $25 million in FY16 to over $150 million in FY25. In 2021, Singapore-based Novo Tellus Capital Partners invested $40 million, continuing to be a significant shareholder and demonstrating strong confidence in the company’s future.

Srini Chinamilli, Co-Founder and CEO of Tessolve, said, “Tessolve has built deep expertise across the semiconductor engineering value chain, including chip architecture, design, test development, and embedded systems. We’re excited to partner with TPG as we enter our next phase of growth, both organic and through acquisitions. This partnership will further strengthen our R&D efforts and drive us to new heights. This milestone wouldn’t be possible without the hard work of our global team and the support of Hero Electronix and Novo Tellus.”

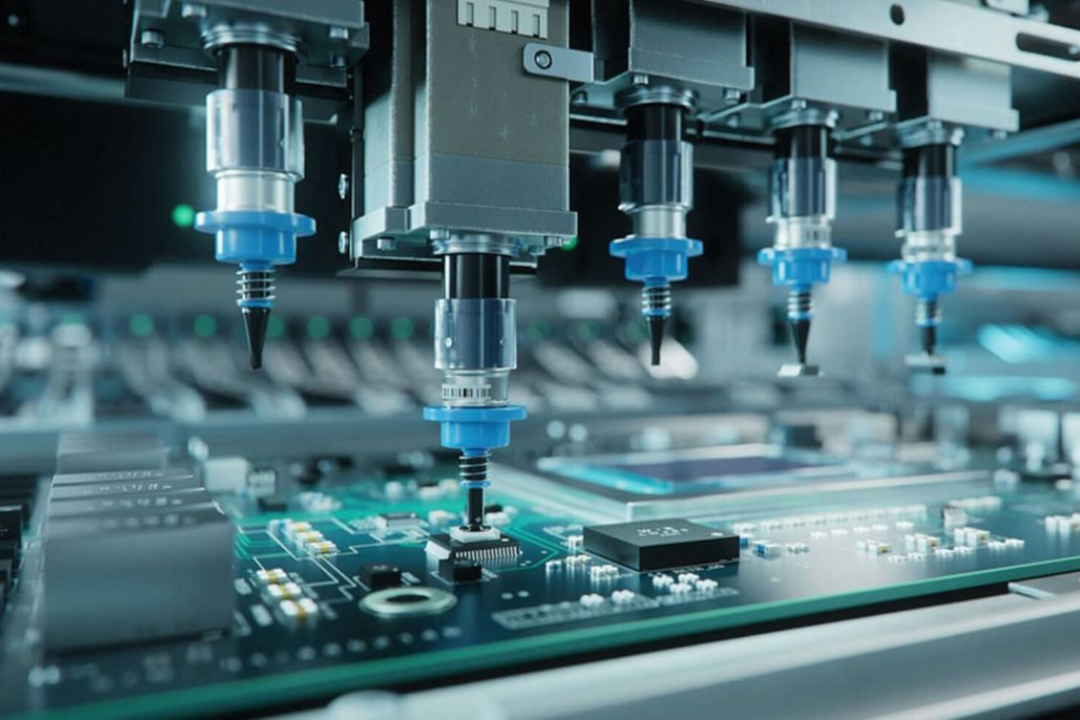

Semiconductors play a crucial role in powering industries like data centers, automotive, and artificial intelligence (AI), making them increasingly strategic to the global economy. Tessolve, a leader in semiconductor engineering services, partners with 18 of the world’s top 20 semiconductor companies. With over 3,000 engineers across India, the US, Germany, the UK, Singapore, and Malaysia, Tessolve operates 11 semiconductor test and embedded labs worldwide, providing comprehensive solutions to its clients.

Bhushan Bopardikar, Business Unit Partner at TPG Growth, said, “Tessolve has evolved from a test engineering lab to a full-service semiconductor engineering provider. With its end-to-end capabilities and status as a trusted partner to fast-growing, tech-forward organizations, we’re excited to add Tessolve to our portfolio of innovative tech companies.”

Founded in 2004 in Bangalore, India, Tessolve is a leading provider of end-to-end engineering services across the semiconductor value chain, covering everything from chip architecture and design to test development and embedded systems. With a presence in over 10 countries, Tessolve serves 9 of the world’s top 10 tech companies. The company’s advanced silicon and system testing labs offer clients a one-stop shop for semiconductor and hardware engineering solutions, helping accelerate market entry with a comprehensive suite of services. For more information, visit www.tessolve.com.

Hero Electronix is the technology arm of the Hero Group, focused on building technology ventures from India that tackle global challenges at the intersection of hardware, software, and AI. Since its inception in 2015, Hero Electronix has invested in a range of businesses, including Tessolve, Qubo (India’s leader in smart security devices), Zenatix (Enterprise IoT solutions), and MyBox (connected media devices).

Novo Tellus Capital Partners is a Singapore-based private equity firm focused on building technology and industrial companies across the Indo-Pacific region. With over $1 billion in assets under management, Novo Tellus distinguishes itself through its deep sector expertise and hands-on partnerships with management teams to build businesses that generate strong, long-term investment returns.

Founded in 1992 in San Francisco, TPG is a global alternative asset management firm with $269 billion in assets under management. TPG invests across a broad range of strategies, including private equity, impact investing, credit, real estate, and market solutions. The firm is known for its collaborative, innovative, and inclusive approach to investment, with a focus on creating lasting value in its portfolio companies.